According to the Small Business Administration (SBA), only about seven out of ten businesses will manage to survive their first two years. The same report by the SBA claims that many small businesses are funded primarily by owner investment and bank credit with most young firms averaging $80,000 in startup investment. With this sort of reliance on credit, you’d expect that businesses and their owners should be incredibly keen about their finances. However, a surprising poll in Fortune identifies some of the top indicators of failure for small businesses as not having enough demand, running out of money, pricing and cost issues, and not having a business model.

The Problem: Taking Credit Lightly

If you find yourself in the situation where your credit score is stopping you from making money online, then the truth is that your online revenue isn’t the only thing your credit score is impacting. A bad credit score is like a figurative stake in the chest of your profit margins and your ability to leverage money in general. Just think about it, the minimum, guaranteed effects of bad credit on your business are high-interest rates for your credit cards and loans, rejection of new loan and credit applications, and issues when getting approved for leasing spaces or on utility payments.

And that stuff above is just the most basic list of things that will happen to you and your business if you simply don’t take credit seriously enough. Any one of these effects can be the cause of the failure of your small business. For example, consider that your business is experiencing a huge increase in the number of its customers so you need some new equipment.

Unfortunately, you can’t leverage the necessary capital to buy that new equipment because your credit was already in the dumps from risky

financial decisions you’ve made for the business in the past and as a result your business’ opportunity for growth never comes to fruition – all because of credit.

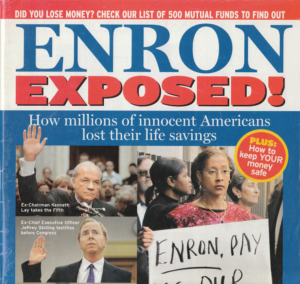

Let us take a look at one of the most infamous events involving the failure of a large business because of its lack of respect for credit in general – the Enron scandal. The Enron scandal refers to the disastrous bankruptcy of the Enron Corporation in 2001 as a result of the gross mishandling of finances and deceit involved in Enron’s dealings with its own shareholders, investors, and other companies. An article published by The Economist shortly after the incident remarks on one of the company’s most significant accountants:

“Andersen, the company’s auditor, has admitted to an “error of judgment” in its treatment of the debt of one of Enron’s off-balance-sheet vehicles; these vehicles led to an overstatement of profits by almost $600m over the years 1997-2000.”

Whether your business is small or large, it should have a stainless and stellar reputation when it comes to credit since the financial consequences of the alternatives are grave.

How to Mitigate Credit Issues as a Small Business Owner

So, how do these credit issues apply to you as a small business owner who has upstanding morals and strives to make good on his debts? As it turns out, there are inherent issues when it comes to banks lending small businesses credit because loans to small businesses are often seen as big liabilities with small returns. As a conscientious owner of a small business, it is also important for you to be taking an active role in attempting to mitigate credit issues in order to put your business in the best possible position to excel, adapt, and profit.

FICO, one of the standards for how financial institutions determine and interpret your credit score, has published a number of guidelines that small business owners can follow in order to boost the perception of their creditworthiness. One of FICO’s case studies reports the following methods as some of the most effective:

- Decrease delinquency and charge off rates

- Reduce the cost of full-scale annual reviews

- Improve the management of loan loss reserve

- Satisfy regulators and auditors by using an analytical approach that is consistent and routinely validated

- Improve cross-sell efficiencies and product per customer ratio.

One of the biggest factors holding any business back is the inevitable prospect of a charge off. A charge off occurs when a financial institution such as a bank reports to a credit bureau that they believe it is unlikely that you will pay off one of the debts you owe – it impacts your credit score in an incredibly negative way. Luckily, there are a number of firms such as Lexington Law that specialize in credit repair and can aid your business through their consultative and legal services in removing harmful records like charge offs and negotiating forgiveness.

Don’t slack when it comes to your own credit or your businesses. Laziness on the part of the debtor to tend to their financial responsibilities can quickly turn into something that is punished with much greater gusto – negligence.

_

Guest post by Jimy Burris